Obtaining the Foreign Identity Number (NIE) is the first essential step.

Obtaining the Foreign Identity Number (NIE) is a crucial and indispensable step for purchasing or renting a property in Spain. This comprehensive guide will provide you with all the necessary information to easily obtain your Foreign Identity Number (NIE).

Without this Foreign Identity Number (NIE), it will be impossible for you to buy or rent an apartment in Spain. Furthermore, working in Spain or obtaining a social security number also depends on it.

Therefore, it is the first procedure to undertake if you plan to invest in Spanish real estate, and it costs a modest fee of less than 10 euros.

Here you will find all the information related to the Foreign Identity Number (NIE) in Spain.

What is the Foreign Identity Number (NIE)?

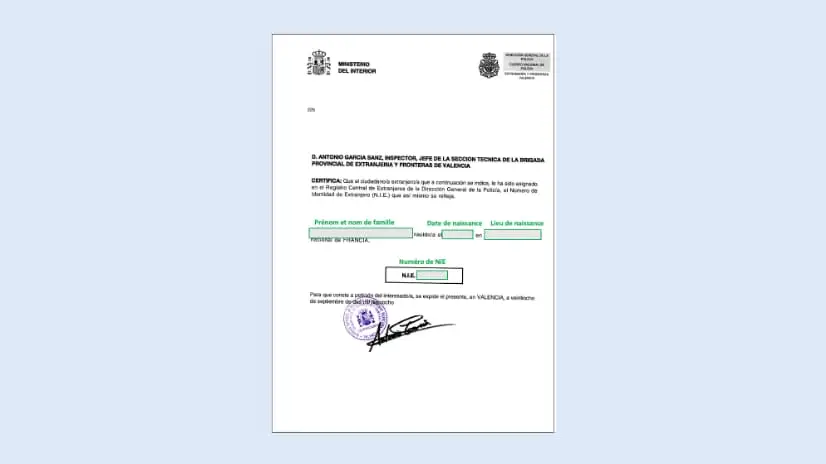

The Foreign Identity Number (NIE), or « Número de Identidad de Extranjero, » is a personal and unique identification number issued by the General Directorate of the Police to every foreigner in Spain.

This number is essential for any interaction with public administrations and for most socio-economic and professional transactions between individuals, including real estate purchases.

The format of the Foreign Identity Number (NIE) includes an initial letter (X, Y, or Z), followed by seven digits and ends with a verification letter, for example, Y6671688B.

This number remains valid throughout your life for all activities in Spain. The Foreign Identity Number (NIE) serves both as physical identification (NIE) and for tax purposes (NIF).

Not an identity document

It is important to note that the Foreign Identity Number (NIE) is not an identity document. European citizens must, therefore, possess, in addition to the NIE, a valid identification document from their country of origin (passport or national identity card).

For a European residing for less than three months in Spain, the national identity card or passport is sufficient.

Buying as a couple

If you plan to buy real estate as a couple, each person must obtain their own Foreign Identity Number (NIE).

In Spain, other identification documents exist, such as the DNI (Documento Nacional de Identidad) for Spanish citizens, the CIF (Código de Identificación Fiscal) for companies and legal entities until 2008, and the NIF (Número de Identificación Fiscal).

Since 2008, the NIF has replaced the CIF for companies, corresponding to the DNI for Spaniards and the Foreign Identity Number (NIE) for foreigners.

Purchasing through a company

To buy real estate in Spain through a company, it is necessary to obtain a NIF from the Spanish Tax Agency. For more information about that, read our article : « Everything you Need to Know About Buying Property in Spain Through a Company.«

What is the Foreign Identity Number (NIE) used for?

The Foreign Identity Number (NIE) is a key element for completing a multitude of procedures in Spain, hence the importance of applying for it as soon as possible.

The process of obtaining it can take up to two months.

This number is crucial for several activities, many of which are inaccessible without it. Here are its main uses:

- Housing: For buying or selling real estate, signing mortgages, registering properties, and managing notarial documents.

- Administration: For registration, obtaining housing permits, paying property taxes, vehicle taxes, managing real estate capital gains, work permits, civil registration, and access to health insurance cards.

- Social security: Necessary for social security enrollment, applying for services with the INEM (unemployment management), and transferring unemployment benefits from an EEA member state.

- Economic relations: Essential for payroll management, paying national and regional taxes, non-resident taxation, setting up businesses, corporate taxes, VAT, and inheritance and gift taxes.

- Other: Used for opening bank accounts, enrolling minors in school, validating degrees, buying or transferring vehicles, obtaining a driver’s license, and signing up for services like electricity, water, phone, and internet.

Where to obtain your Foreign Identity Number (NIE)?

Whether you are in Spain or abroad, patience will be your indispensable ally. The process can vary significantly, from one week to sometimes up to three months.

If you are in Spain

To obtain the Foreign Identity Number (NIE) in Spain, you must exclusively go to local National Police stations.

Appointments are made through the official website administracionespublicas.gob.es, but be warned, getting an appointment can be very difficult!

Steps to make an appointment in provincial capitals:

- Select your region in the drop-down menu « Seleccionar » under « PROVINCIA DISPONIBLES. »

- Under « TRÁMITES CUERPO NACIONAL DE POLICÍA, » choose « POLICIA-CERTIFICADO DE REGISTRO DE CIUDADANO DE LA UE. »

- On the page that opens, click « Entrar. »

- Select « Pasaporte, » enter your passport number as well as your first and last name.

- Click « Solicitar Cita. »

The site may indicate that no appointments are available. In that case, follow these tips:

Tip 1: Log in to the website on Monday mornings at 8 AM, when new slots are often released. If necessary, refresh the page every 5 minutes until 9 AM.

Tip 2: Try a police station in a smaller town within the same Autonomous Community, where demand is lower. Arrive early, an hour before opening, and be prepared to return several times if necessary.

Tip 3: Hire a lawyer (costs around €250 per person, plus a notarized power of attorney for about €80). We can provide you with the contact details of a lawyer.

Once the appointment is obtained, fill out the forms EX-15 and the modelo 790 código 012 for the tax (9.84 € in 2022). Bring all the required documents on the day, and expect a wait of up to 3 hours.

After paying the tax at a bank, return to the police station to collect your Foreign Identity Number (NIE).

If you are not in Spain

You can request the Foreign Identity Number (NIE) personally from the Spanish consular authorities in your country of residence.

Make an appointment with the nearest Spanish consulate. Each consulate has its own appointment procedure, which may vary.

For some consulates, you can make an appointment online or by phone. Others, allow walk-ins without an appointment. Make sure you go to the consulate corresponding to your place of residence.

On the day of your appointment, bring the EX15 and 790 forms, a copy of your ID or passport, proof of residence, and a stamped envelope for the return of the Foreign Identity Number (NIE). The tax payment (9.84 €) is required, payable by check or cash.

The waiting time to receive the Foreign Identity Number (NIE) ranges from 2 to 4 weeks, either by mail or email.

Note: If you are abroad and do not wish to handle the Foreign Identity Number (NIE) request yourself, a specialized lawyer in Spain can take care of it for around €150 per request. This will require a notarized power of attorney and its certified translation.

The waiting time to receive the Foreign Identity Number (NIE) is typically 3 to 4 weeks.

Alternatively, companies such as NIEnumberfast.com and e-residence.com specialize in this process and can assist you for around €200.

What forms to complete?

To obtain your Foreign Identity Number (NIE), two essential forms must be completed: the EX-15 form and the 790 form. They must be filled out in CAPITAL letters, either directly on the computer or manually.

EX-15 Form

Download the EX-15 form by clicking here. This document is in Spanish and must be completed in CAPITAL letters and in SPANISH.

For your convenience, here is a detailed step-by-step guide to filling out the forms EX-15 and 790-012, along with some additional tips:

- « Nombre » means first name in Spanish, while « apellido » is the last name.

- For the « Sexo » (sex) question: H for male (hombre) and M for female (mujer).

- For « Estado Civil » (marital status): S for single (soltero), C for married (casado(a)), V for widowed (viudo(a)), D for divorced (divorciado(a)), Sp for separated (separado(a)).

- Don’t forget to enter your email in the dedicated question.

- Do not fill out sections 2 and 3.

- In section 4.2 « Motivos », check the appropriate reason, economic, professional, or social. For example, for a real estate purchase, check « Por intereses económicos » and add « compra de una vivienda en España » or specify the city or region.

- Sign in the box « Firma del solicitante ».

Form 790 Código 12

The 790 form is used for the payment of fees related to obtaining the Foreign Identity Number (NIE). You can download it here: Tasa modelo 790 Código 012.

Here are the instructions for completing it (in capital letters):

- Check « Asignación de Número de Identidad de Extranjero (NIE) a instancia del interesado ».

- NIF/NIE: ID card number or passport number.

- Apellidos y nombre o razón social: Last name and first names.

- Calle/plaza/avda: Type of road (street, square, avenue).

- Nombre de la vía pública: Name of the street.

- Número: Street number.

- Teléfono: Phone number.

- Municipio: Town/city.

- Código postal: Postal code.

- Provincia: Indicate your country of residence (France, Belgium, Switzerland, Luxembourg, etc.).