In 2023, out of the 640,000 properties sold in Spain, 15% were purchased by foreigners (9, 5% of whom were from England, 1, 6% of whom were American). In this context, buying a Property in Spain through a company is becoming an increasingly popular strategy among savvy investors. Here’s why.

Introduction

Purchasing property in Spain is an exciting opportunity, but it comes with important decisions that can really impact your investment. One such decision is whether to buy property as an individual or through a company. Each option presents its unique set of advantages and drawbacks, and the right choice depends largely on your financial goals, tax planning, and the property’s intended use.

While individual ownership is more common among homebuyers, buying property in Spain through a company offers substantial benefits, particularly for investors or those seeking asset protection. This article will delve into the differences between these two methods and highlight the advantages of buying through a company. Let’s go.

Types of Companies for Property Purchase

LLC vs LTD: Key Differences

When considering buying property in Spain through a company, it’s important to understand the main types of business structures available. Two common options are the LLC (Limited Liability Company) and the LTD (Limited Company). Here’s a comparison:

Geographic Use:

- LLC: Primarily used in the United States

- LTD: Common in the UK and Commonwealth countries

Ownership Structure:

- LLC: Owned by « members » who can manage directly or hire managers

- LTD: Owned by « shareholders » who appoint directors for management

Liability Protection:

- LLC: Members not personally liable for company debts

- LTD: Shareholders’ liability limited to their investment

Taxation:

- LLC: Flexible tax options available

- LTD: Taxed as a corporation on profits

Administrative Requirements:

- LLC: Fewer formal requirements, more flexible

- LTD: Stricter rules, including regular meetings and financial reporting

Suitability:

- LLC: Generally more suitable for small businesses due to flexibility

- LTD: More appropriate for larger or more formal business structures

Factors to Consider When Buying Property in Spain through a Company

When deciding how to structure your property purchase, there are several critical factors to consider:

Intended Use of the Property

The intended use of the property is a major determinant when deciding between individual or company ownership. If the property is primarily for personal use, such as a holiday home or primary residence, individual ownership is often simpler and more cost-effective.

However, if the property is intended as an investment property (for rental income or future resale), the benefits of buying through a company become more significant. A company structure allows investors to take advantage of various tax benefits, legal protections, and management flexibilities.

Tax Implications of Property Ownership

Taxation is a key factor in determining the best structure for buying property. The tax consequences of buying property in Spain through a company differ considerably from those faced by individual buyers.

Corporate tax rates may offer a more favorable tax environment for real estate investors compared to personal income tax. Additionally, a company can often deduct property-related expenses, such as maintenance and repairs, from taxable income, further reducing the overall tax burden.

- VAT (IVA): New property purchases are subject to a reduced IVA rate of 10% on the declared value, regardless of whether the buyer is an individual or a company.

- Stamp Duty: The Impuesto de Actos Jurídicos Documentados (AJD) applies to notarial, mercantile, and administrative documents. Rates vary by autonomous community, ranging from 0.5% to 2%.

- Property Yax (IBI): The annual Impuesto sobre Bienes Inmuebles (IBI) is based on the property’s cadastral value. Rates typically range from 0.4% to 1.1%, depending on the municipality.

- Corporate Income Tax: Companies owning property in Spain are subject to a flat 25% corporate tax rate on profits, including rental income.

- Capital Gains Tax: When selling the property, companies pay capital gains tax at the standard corporate tax rate of 25%.

- Non-Résident Income Tax: Foreign companies may be liable for the Impuesto sobre la Renta de No Residentes on rental income or deemed income from the property.

Additional Considerations

- VAT deductions may apply if the property is used for economic activities.

- Companies must charge market-rate rent to shareholders using the property for personal purposes, subject to corporate tax.

- Expenses related to property management and maintenance are generally tax-deductible.

Terreta Spain’s advice: if you are considering buying in Spain through a property company, contact us. Our team has extensive experience and will guide you through the process.

Advantages of Buying Property Through a Company in Spain

While purchasing property through a company can involve more legal and administrative requirements, the advantages are significant, particularly for investors or those buying multiple properties.

Tax Deductions on Property Expenses

Consider an investor who buys a property through a Limited Company (LTD) in Spain. If the property is rented out, the rental income is subject to a corporate tax rate of 25%. However, the company can deduct expenses like repairs, utilities, and management fees, reducing the taxable profit. This results in a lower tax liability compared to buying the same property as an individual, where these deductions are less accessible.

VAT Deduction on Property Purchases

Another significant advantage for companies is the ability to deduct VAT (Value Added Tax) on the purchase of a new property. In Spain, VAT on new residential properties is typically 10%, we’ve said it, but for companies purchasing properties for commercial or investment purposes, this VAT can often be reclaimed. This option is not available for individuals buying property for personal use.

Anonymity and Privacy Protection

For buyers who value privacy, purchasing property in Spain through a company offers enhanced anonymity. The company’s name, rather than the individual’s, is listed in public records, providing an additional layer of privacy. This can be especially important for high-profile individuals or those concerned about safeguarding their personal information.

Long-Term Asset Management

For real estate investors with long-term plans, owning property through a company can simplify asset management and estate planning. It provides flexibility for transferring ownership or shares, facilitating the seamless transfer of assets to heirs or business partners.

Limited Liability Protection

One of the most significant advantages of purchasing property through a company is the limited liability it offers, meaning your personal assets are shielded from potential claims or debts related to the property. This is especially beneficial for real estate investors with large portfolios or those concerned with protecting personal wealth.

For individual buyers, the risk of personal liability in property disputes or financial difficulties related to the property is higher, as there is no separation between personal and property-related obligations.

Advice from Terreta Spain: if you’re thinking of purchasing property in Spain through a company, reach out to us. With our extensive experience, we’ll expertly guide you every step of the way.

Steps to buying a Property in Spain in the Name of a Company

- In the Country of Origin:

- The foreign company must collect key documents, including the articles of incorporation, tax ID, bylaws, and proof of registration. These documents should clearly indicate the company’s authorized representatives and shareholders.

- All documents must be translated into Spanish by an official translator and legalized with an Apostille to be valid in Spain. For countries outside the Apostille Convention, additional certification from the Ministry of Foreign Affairs is required.

- In Spain:

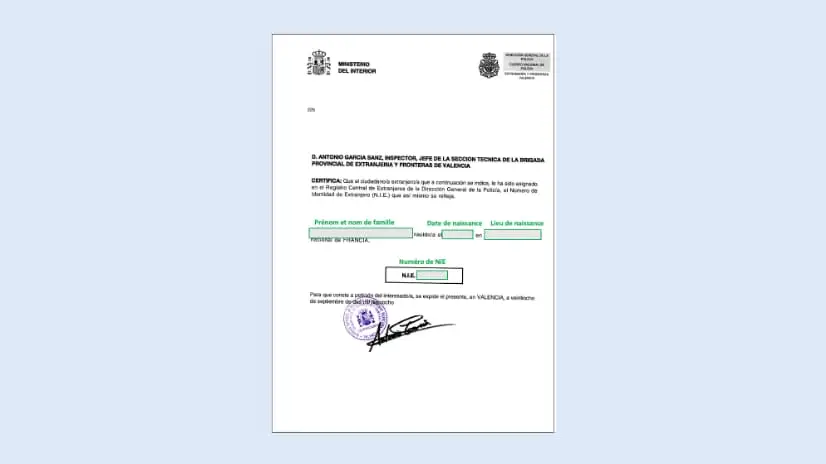

- NIE (Foreigner’s ID): The company’s administrator must obtain an NIE to register in the Spanish tax system.

- NIF (Tax ID): The foreign company must also obtain a NIF to conduct business in Spain, by submitting the legalized and apostilled documents to the Spanish Tax Agency.

- Fiscal Representative: Companies without a permanent establishment (NO PE) are required to appoint a tax representative in Spain to handle tax-related matters and communications. For companies with a permanent establishment (PE), the tax representative shares full responsibility for the company’s tax obligations.

- Bank Account: To operate in Spain, the company needs a bank account in its name. Documentation and financial information will be required to comply with anti-money laundering regulations. Best advice would be to contact Sabadell Welcome Hub in Barcelona. This bank is 100% dedicated to foreigners buying a property in Spain. They know all about purchasing real estate in Spain through a Company.

- Beneficial Ownership Declaration: The notary will require a declaration of the company’s beneficial owners (those holding more than 25% of shares) to verify the origin of funds and meet anti-money laundering regulations.

- Power of Attorney: Due to the complexity of these procedures, it’s recommended to grant power of attorney to a lawyer or manager to handle the process on the company’s behalf.

Advice from Terreta Spain: If you’re thinking of purchasing property in Spain through a company, reach out to us. With our extensive experience, we’ll expertly guide you every step of the way. Additionally, Terreta Spain connects you with specialized international tax experts, ensuring that all legal and fiscal aspects of your transaction are handled with the highest level of expertise.

While there are numerous benefits to buying property through a company, there are also some potential downsides to consider.

Drawbacks of Buying Property Through a Company

Higher Administrative and Legal Costs

Setting up and maintaining a company in Spain involves ongoing administrative and legal costs. These can include incorporation fees, accounting services, and filing annual tax returns. For buyers acquiring a single property for personal use, these additional costs may outweigh the benefits of company ownership.

Complex Legal Requirements

The legal requirements for buying property through a company are generally more complex than for individual buyers. This includes the need for legal representation and compliance with corporate governance regulations, which can be more time-consuming and costly.

Warning about Inheritance tax

It’s not a good idea to purchase a property in Spain in the name of a company to avoid paying inheritance tax. Even if you read so…

Since 2010, Spain requires the names of shareholders and beneficiaries owning at least 25% of a foreign company purchasing real estate in Spain.

This allows authorities to easily identify the real owners and tax them accordingly.

In summary, attempting to avoid Spanish taxes by buying through a foreign company is risky, potentially illegal, and unlikely to succeed in the long term.

Is it possible for a company to secure a mortgage in Spain for property acquisition?

It’s possible to obtain a mortgage in Spain for a company to purchase property, do not worry about that. But it can be more complex than getting a personal mortgage.

Here are some key points to consider:

- Lender options: Some Spanish banks offer mortgages to companies, but your choices may be more limited compared to individual borrowers.

- Higher down payments: Companies typically need to provide larger down payments, often 30-50% of the property value, compared to 20-30% for individuals.

- Stricter requirements: Banks usually have more stringent criteria for company mortgages, including a thorough review of the company’s financial health and business plan.

- Interest rates: Company mortgages often come with higher interest rates than personal mortgages.

- Guarantees: The bank may require personal guarantees from company directors or major shareholders.

- Documentation: You’ll need to provide extensive company documentation, including financial statements, tax returns, and proof of income.

- Specialized lenders: Some banks, like Sabadell or CaixaBank, have departments specializing in mortgages for foreign companies buying property in SpainIt’s advisable to consult with a Spanish mortgage broker or financial advisor who specializes in corporate property purchases to navigate this process effectively. Contact us to guide you through this.

When to Consider Individual Property Ownership

For many buyers, particularly those looking to purchase a primary residence or a vacation home, individual ownership is the simpler and more practical option.

Simplified Taxation for Individuals

For individuals, property-related taxes are generally simpler and more straightforward than those faced by companies. While corporate tax structures can provide advantages for investors, personal income taxes may be more manageable for those buying property for personal use.

Fewer Administrative Requirements

Owning property as an individual means fewer administrative burdens. You won’t need to manage corporate filings, comply with regulations, or maintain separate accounting systems. This can be especially appealing for buyers who are not planning to use the property for commercial purposes.

Steps to purchase a Property in Spain

So know, what should you do to purchase that house of your dreams in Spain? Here’s a concise five-step guide for buying property in Spain:

- Obtain a NIE (Foreigner Identification Number)

- Read the full process on the official website and fill the EX-15 and the 790 form.

- Visit a police station with your passport to apply

- Processing time: a few weeks

- Hire Key Professionals

- Engage a local lawyer specializing in property transactions

- Consider hiring a property specialist to assist with the process. Terreta Spain’s experts are here for that, we can manage both. Contact us.

- Make an Offer and Sign Preliminary Contract

- Once offer is accepted, sign a preliminary contract

- Pay a deposit, typically 10% of the purchase price

- Arrange Financing

- Complete the Purchase

- Sign the contract of sale (escritura de compravento) before a notary

- Pay the full sale price, taxes, and other costs

- Property ownership is transferred to you

6. Additional Costs to Consider

- Property transfer tax: 6-10% for existing properties, 10% VAT for new properties

- Notary costs, title deed tax, and land registration fee: 1-2.5%

- Legal fees: 1-2% (including VAT)

Remember to consult with local experts throughout the process, as regulations and procedures may vary by region in Spain.

Terreta Spain is here to help you every step of the way, including with the legal aspects of your purchase. Fell free to contact us.

Conclusion

Deciding whether to purchase property in Spain through a company or as an individual depends on your financial objectives, the property’s intended use, and your long-term plans. While individual ownership offers simplicity and fewer administrative burdens, company ownership provides significant tax benefits, legal protections, and greater flexibility, particularly for real estate investors.

Before making a decision, it’s essential to consult with legal and financial professionals who specialize in Spanish real estate. This will ensure you make an informed choice that aligns with your goals and maximizes the benefits of your property investment.

FAQs: Buying Property in Spain Through a Company

Is it better to buy property in Spain through a company or as an individual?

It depends on your goals. Buying through a company offers tax benefits and legal protections, particularly for investors. However, for personal use, individual ownership is usually simpler and less costly.

What are the tax benefits of buying property through a company in Spain?

Companies can deduct property-related expenses, such as maintenance and repairs, from taxable income. Additionally, companies may be able to reclaim VAT on the purchase of new properties, which is not available for individual buyers.

Can a company buy a residential property in Spain?

Yes, companies can purchase residential property in Spain. However, the tax advantages are more significant if the property is used for investment or commercial purposes.

What are the disadvantages of buying property through a company in Spain?

The main disadvantages include higher administrative costs, more complex legal requirements, and the need to comply with corporate governance regulations.

Can I obtain a mortgage in Spain to buy property through a company?

Yes, you can get a mortgage in Spain for a company to purchase property, but it may be more complicated than getting one as an individual. Here are the key points:

Specialized Lenders: Some banks, like Sabadell or CaixaBank, specialize in financing for foreign companies buying property in Spain.

Lender Options: Some banks offer mortgages to companies, but choices may be limited compared to personal mortgages.

Down Payments: Companies often need to provide larger down payments, usually between 30-50%.

Stricter Requirements: Banks typically have more stringent criteria for company mortgages, including a review of the company’s financial health.

Interest Rates: Mortgages for companies may come with higher interest rates.

Documentation: Extensive documentation is required, including company financials and proof of income.

Is buying property through a company in Spain worth it for a single property?

For a single property intended for personal use, the costs and complexities of setting up a company may outweigh the benefits. However, if the property is an investment or part of a larger portfolio, company ownership may offer significant advantages.

Sources :